Materiality Assessment

Double Materiality Assessment

Shinhan Financial Group conducts a materiality assessment every year for systematic, timely identification and management of environmental, social, and governance (ESG) issues and for transparent stakeholder communication regarding these issues.

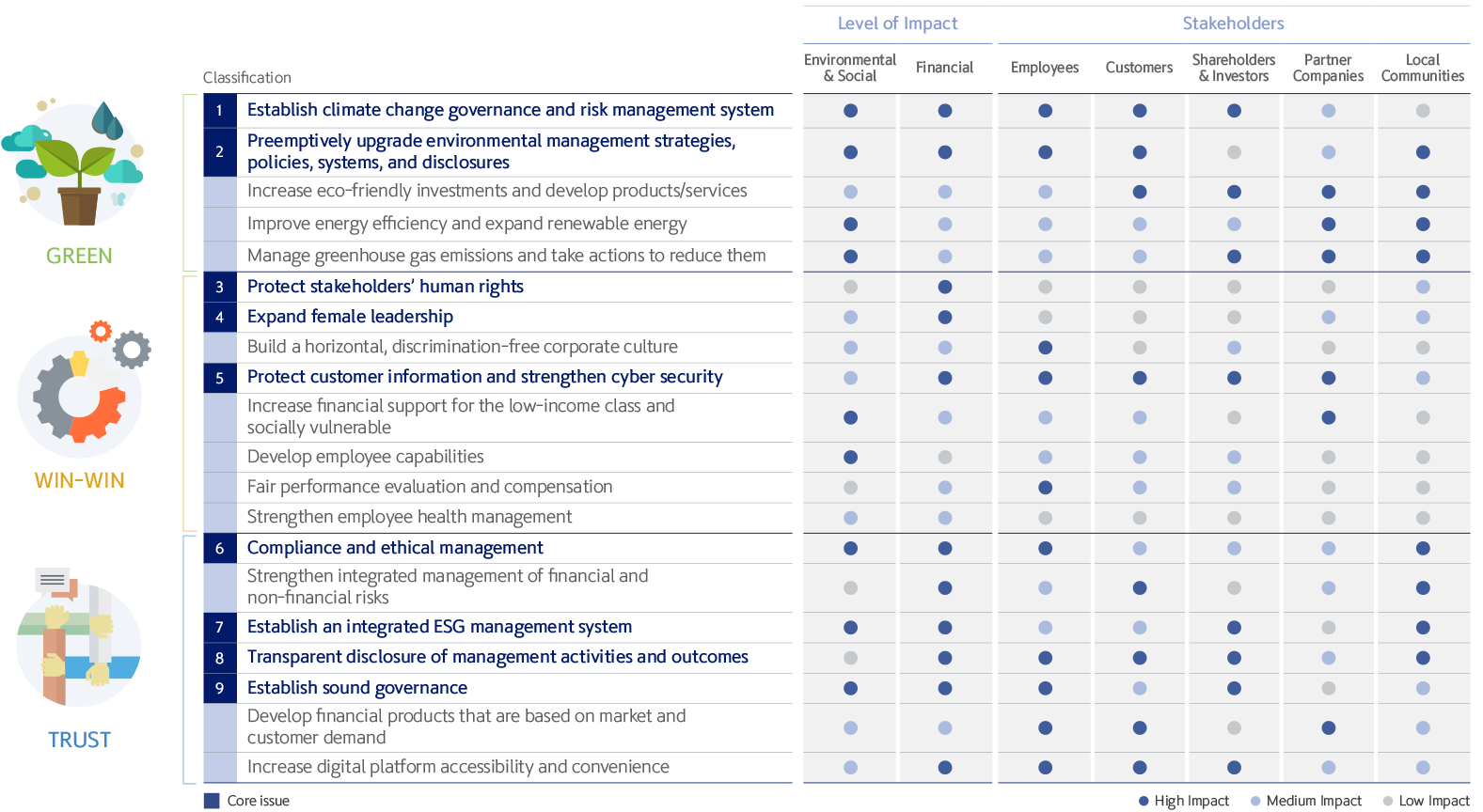

We applied the “Materiality” principle of the Global Reporting Initiative (GRI) Standards, which are global sustainability management reporting guidelines, and the concept of double materiality to conduct a materiality assessment. We categorized key issues that were derived through a materiality assessment into our three major strategic directions, which are green, win-win, and trust, and strived to faithfully disclose information on relevant activities and outcomes.

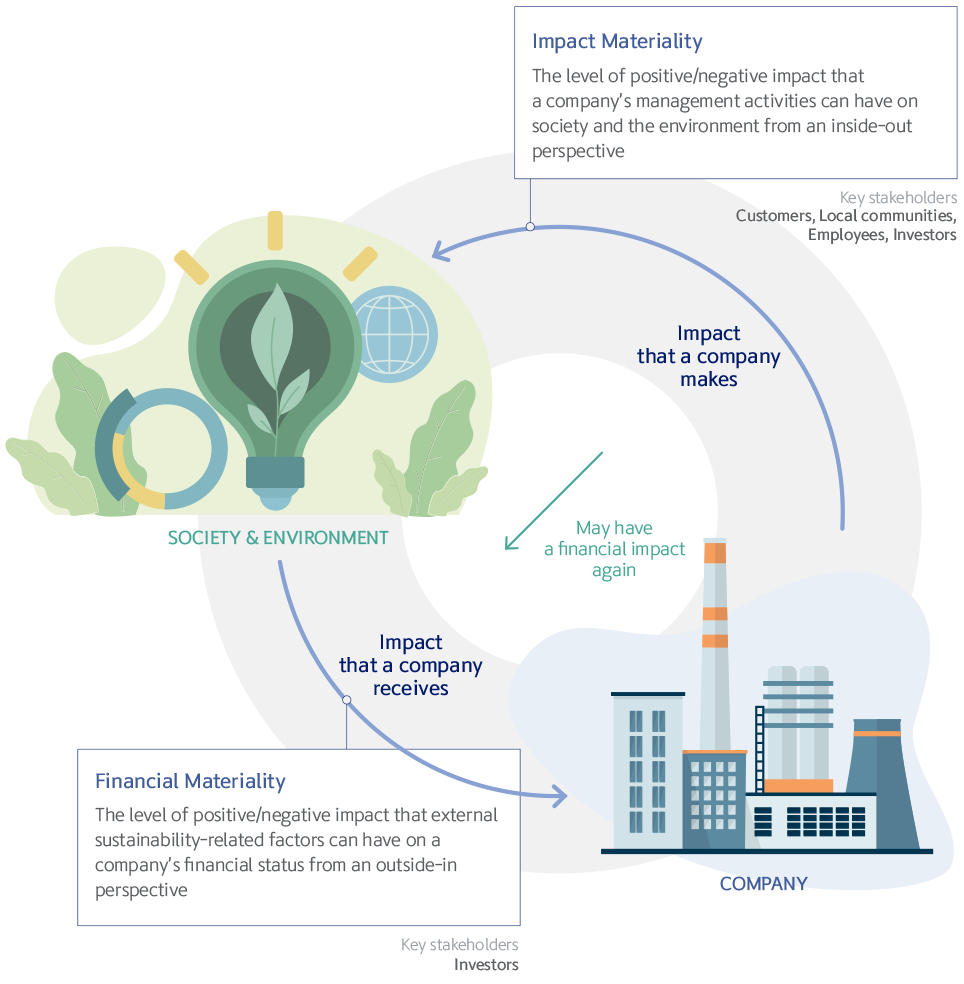

Concept of Double Materiality

The double materiality concept refers to the need to consider both internal and external perspectives, in other words, external sustainability-related environmental and social factors that impact a company’s financial state and the external impact of a company’s management activities. Through this, a company can clearly understand stakeholders’ concerns and expectations and reflect them in its management strategies in anticipation of business performance improvements, while also more closely reflecting environmental and social value throughout corporate activities. As sustainability management has become increasingly important and upgraded, major organizations are active in adopting double materiality assessment. Also, relevant guidelines are being announced mainly by the European Union (EU)¹, World Economic Forum (WEF)², and GRI³. This is why this concept is expected to gain greater importance.

¹ Announced the Non-Financial Reporting Directive (NFRD) that includes the double materiality concept in June 2019, announced the Corporate Sustainability Reporting Directive (CSRD), which is a revision, in April 2021 (planned to take effect in 2023)

² Published “Embracing the New Age of Materiality Harnessing the Pace of Change in ESG” in March 2020

³ Announced a plan to make it a requirement to adopt the double materiality assessment starting in 2023

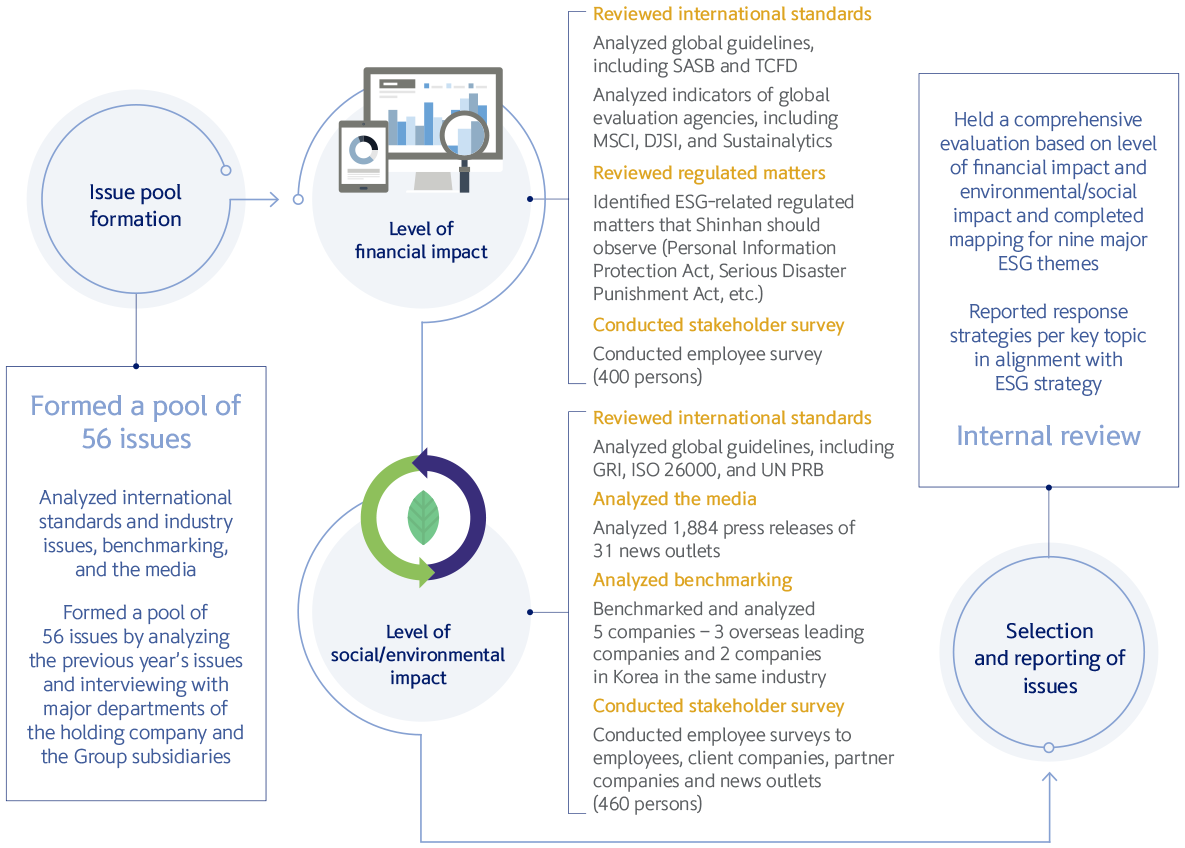

Double Materiality Assessment Process

To derive more transparent and reliable key ESG issues and respond to global initiative changes, Shinhan Financial Group adopted the double materiality concept for the first time this year and conducted an assessment. We established an assessment methodology based on relevant principles in GRI and CSRD, which are global standards, and comprehensively reflected international standards, media analysis, benchmarking analysis, and internal/external survey outcomes.

Feature of the 2021 Materiality Assessment

Upgrading the analysis method

Conducted in-depth interviews with departments in charge to upgrade the pool of issues Developed an assessment methodology to adopt the double materiality assessment concept

Changing the method of communicating analysis results

Changed from the previous way of communicating key issues in matrix format to a table-type diagram Anticipate effective informationsharing for core issues regarding level of financial or environmental/social impact

Activities & Outcomes

| GRI Index | |||

|---|---|---|---|

| 1 | Establish climate change governance and risk management system |

We completed the establishment of methodology and database to measure financed emissions in accordance with the PCAF Standard, in our efforts to achieve our carbon neutrality goal. | 305-3 |

| 2 | Preemptively upgrade environmental management strategies, policies, systems, and disclosures |

We became the first financial company in Korea to build a preemptive response system

from an investment perspective by creating the “Green IB Execution Lab” and “ESG Global Desk”. |

2-12 |

| 3 | Protect stakeholders’ human rights | We manage human rights risks through a human rights impact assessment every year, while also strengthening communication with stakeholders by releasing our first Human Rights Report in 2022 in advance. | 2-23 |

| 4 | Expand female leadership | We set the mid-to long-term goal for the percentage of female leaders (executives and division heads) at the ESG Strategy Committee, and the percentage of female executives of the Group increased from 6.6% in 2019 to 7.5% in 2021. | 3-3 |

| 5 | Protect customer information and strengthen cyber security |

We are strengthening the financial consumer protection system at the Group level, and are strengthening our cyber security system by making such efforts as the opening of a global information protection portal system (Shinhan Bank). | 418-1 |

| 6 | Compliance and ethical management | We have established a compliance response system in response to the enactment and implementation of laws, and are solidifying ethical management through employee ethics and compliance training and a pledge to practice ethics every year. | 2-23 |

| 7 | Establish an integrated ESG management system |

We established the ESG Implementation Committee, run by the Group CEO and participated by all Group subsidiary CEOs, to upgrade our ESG driving system, and are internalizing ESG throughout our overall management activities by establishing the ESG performance management system. | 2-9 |

| 8 | Transparent disclosure of management activities and outcomes |

We are communicating with stakeholders by regularly and continually disclosing ESG management activities and outcomes through diverse channels, including various special reports (TCFD/Human Rights/Diversity Reports) and website. | 2-3 |

| 9 | Establish sound governance | We strengthened the BOD’s independence and transparency by appointing an independent director as the BOD Chairperson, and observe “BOD Diversity Guidelines”. | 2-9 |